"Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)" (6speedhaven)

"Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)" (6speedhaven)

01/08/2016 at 18:41 ē Filed to: None

0

0

22

22

"Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)" (6speedhaven)

"Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)" (6speedhaven)

01/08/2016 at 18:41 ē Filed to: None |  0 0

|  22 22 |

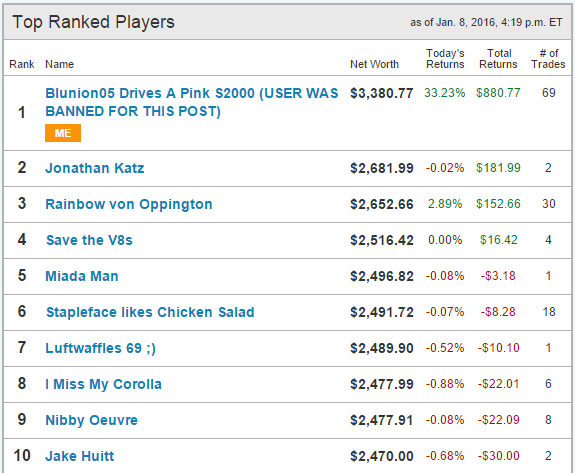

With the OppositeStock game under way, the first week was one hell of a rumble and tumble. According to one article, the average investor is down 5.1% for the first week. Which isnít a lot if you donít have too much skin in the game. Maybe the market will bounce back if this is a result of the bad news from China. Without further ado, here are the top 10 rankings to end the week:

First off, Iíd like to thank everybody who has joined so far! We have 35 players, but we are missing 5 from the rankings leaderboard! I hope those 5 initiate some trades soon so they can appear on the rankings.

The day kicked off the morning with most of the top 10 in the positives, but as the hours progressed the market caused most everyone to drop into the red. 26 Opponauts finished with less than the $2500 starting balance, which just goes to show how horrid the market has been.

That left only 4 of us wrapping up the week with three of us growing a wide gap between everybody else.

Rainbow was engaged in some volatile rank changes with a penny stock, and Jonathan has a short on CMG going extremely well in his favor. Jonathan was initially in the lead for two or three days.

I was steady in third, initially starting the day at $2600, then began swapping to fourth several times fluctuating between $2,550 and $2,560. I amounted a high number of trades as I was researching some long term stocks for my preferences. I left for the morning and came back 15 minutes before the market close to see one of my short-term stock picks skyrocketed and I made out like a bandit. I did not expect my pick to net me $880, considering it was high risk and little gain and anticipated only ~$100.

Iíd like to add in that everybodyís favorite darling from the previous game, AKA, AMZN, is down nearly $86, or around 13.5%!

If this has caught your interest and youíd like to join in on the game, head right on to !!!error: Indecipherable SUB-paragraph formatting!!! ! You can also view the first dayís rankings post I made !!!error: Indecipherable SUB-paragraph formatting!!! .

Rainbow

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Rainbow

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/08/2016 at 18:54 |

|

Holy crap, I didnít notice how much you made today!

I was honestly expecting everyone to finish within a couple hundred bucks of the starting amount, considering weíre not experts (Or, if anyone here actually is an expert, theyíre probably too busy with the real thing to play this) and all I know about investing came from Trading Places .

But now, Iím thinking the winner will be up to at least $20,000 by the end of the game. Maybe higher, but Iím sure people will be trading less often as it goes on.

Van Man, rocks the Man Van

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Van Man, rocks the Man Van

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/08/2016 at 18:58 |

|

Keep in mind the game is a year long, so it's not like the first week really matters.

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Van Man, rocks the Man Van

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Van Man, rocks the Man Van

01/08/2016 at 19:12 |

|

Iím aware of that ó hence why I mention in the opening paragraph that if the market is down because of China, then it doesnít matter. But the next week or two are also going to be a rough ride as well and volatility might go up.

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Rainbow

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Rainbow

01/08/2016 at 19:15 |

|

Yeah. Iíve been doing a lot of trading trying to find the perfect ďset it and forget itĒ portfolio and allocating an equal amount of cash to each stock I pick. So far I have one solid pick and have 9 total stocks in my portfolio at the moment. Iím also going to keep some of my cash open so I can take opportunities to play ball with short term picks whenever they come and go.

Fortunately, nobody has a hand in any of the stocks Iím currently holding, which likely also means the ones Iím researching likely are only going to be known to me during the period of the game.

Phyrxes once again has a wagon!

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Phyrxes once again has a wagon!

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/08/2016 at 20:14 |

|

Yeah I noticed that it tells you how many people hold it, but not who holds it, which is pretty neat. Right now Iím just trying to ride this out and keep working to diversify.

Nimbus The Legend - Riding on air like a cloud

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Nimbus The Legend - Riding on air like a cloud

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/08/2016 at 20:21 |

|

real stocks? or Investopedia simulator?

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Nimbus The Legend - Riding on air like a cloud

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Nimbus The Legend - Riding on air like a cloud

01/08/2016 at 20:38 |

|

Are you asking real time stocks? or actual, real money? Marketwatchís simulator uses real-time quotes. Iíve yet to try out the other simulators...I hear Investopedia delays all quotes by 20 minutes? ugh.

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Phyrxes once again has a wagon!

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Phyrxes once again has a wagon!

01/08/2016 at 20:39 |

|

If you buy and short a stock at the same time, itíll also tell you that two players are holding it. Minor bug, no biggie.

Van Man, rocks the Man Van

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Van Man, rocks the Man Van

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/08/2016 at 20:53 |

|

I'm really just trying to make myself feel better after losing $150 in a week.

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Van Man, rocks the Man Van

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Van Man, rocks the Man Van

01/08/2016 at 21:22 |

|

Yeah, it really sucks ó my entire portfolio is in the red, except for one stock. All of my profits this week got cashed in via stop loss, only thing keeping me from having less than $2500. I want to sell off anything in the red and sit out until it feels like thereís some flat lining or gain in the broad market. (track the DJIA and/or SPX tickers, these are market indexes to get a good look at the broad marketís behavior)

Master Cylinder

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Master Cylinder

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/08/2016 at 21:44 |

|

I got pummeled this week. I started another solo game as well, to try out some more advanced stuff and trade a little more aggressively, and I lost 15% today alone... I picked a stock I thought was gonna bounce back up and put a large chunk of my money into it. It fell almost 20% in a few hours. Ouch.

The good news is that I learned something, I guess - donít dump most of your money into one stock, and look at more data before you make a decision. If Iíd looked back more than a year it would have been more obvious that the stock was pretty overvalued.

Oh well, live and learn I guess. At least itís not real money!

Stapleface

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Stapleface

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/08/2016 at 22:35 |

|

Damn, I took a hit at the end of the day. I tried something new today, but it might take a bit for it to pay off, if it pays off.

Iím surprised just how poorly one of my stocks is doing right now. I think itís lost like 12% of its value since I purchased. Hereís hoping things stabilize next week.

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Master Cylinder

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Master Cylinder

01/08/2016 at 23:36 |

|

Ouch! Yeah, this game is going to serve as a real good learning experience. Diversification is important. As time goes on and I get my research in order Iím going to start recommending stocks in the discussion sections. I want to see everybody finish in the green when this game ends!!!!!!

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Master Cylinder

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Master Cylinder

01/08/2016 at 23:53 |

|

By the way, if youíre running a solo game, you can reset it as many times as you want ó so if you screw up, do over! LOL

mikethebike

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

mikethebike

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/09/2016 at 03:57 |

|

I just dropped a G on something everyone here hates for a long term investment

Nimbus The Legend - Riding on air like a cloud

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Nimbus The Legend - Riding on air like a cloud

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/11/2016 at 12:34 |

|

Yes. And marketwatch has a simulator?! LOL

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Nimbus The Legend - Riding on air like a cloud

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Nimbus The Legend - Riding on air like a cloud

01/11/2016 at 18:34 |

|

Whatís so amusing about MarketWatch having a simulator?

Nimbus The Legend - Riding on air like a cloud

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Nimbus The Legend - Riding on air like a cloud

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/11/2016 at 18:41 |

|

nothing really, its more amusing that i didnt know they had one, or i would have been all over it for the last few years!

Manwich - now Keto-Friendly

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Manwich - now Keto-Friendly

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/28/2016 at 19:05 |

|

Iíve decided to go in the other direction... to see how LOW I can go... down to a net worth of $52.82!!!

I donít think anyone will beat my TERRIBLE performance...

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Manwich - now Keto-Friendly

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Manwich - now Keto-Friendly

01/28/2016 at 20:23 |

|

hahaha. I can come in with a second account and go straight into debt within the first few days. All Iíd have to do is take my favorite penny stocks and go long LOL

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Manwich - now Keto-Friendly

Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

> Manwich - now Keto-Friendly

01/28/2016 at 20:25 |

|

By the way, do you think your stocks will bounce back? The market was going down when the game started, and itís STILL going down. I noticed that one analyst noted that stocks are correlating with oil prices, when generally, the two move inversely of each other.

Manwich - now Keto-Friendly

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

Manwich - now Keto-Friendly

> Blunion05 drives a pink S2000 (USER WAS BANNED FOR THIS POST)

01/29/2016 at 11:23 |

|

The analyst said stocks are correlating with oil prices? I think thatís a dumb statement to say about ALL stocks... unless youíre buying an index fund.

It really depends on WHICH stocks.

While that may be true for energy-related stocks, itís not true for airlines over the past few years... and definitely NOT true for LABD. And even for a company like FCA... while FCAís share price is down over one year, the share price is still higher than it was for most of 2013.

I was betting that since itís an election year (which almost always is an up year), combined with low energy prices being a benefit for most companies outside of the oil producers, shorting LABD would be a good move... because when the market goes up, LABD goes down.

But LABD has already bounced back very nicely. Too bad I shorted it instead of going long. Good thing Iím not doing this with real money.

I think FCA and airlines like Southwest Airlines have gone down recently because of statements from OPEC that implied that oil prices will be heading back up... combined with looming tighter emissions/pollution standards. That expectation would hurt the bottom line of companies like that... or at least, thatís what I believe some in the market are thinking.

The tech to improve emissions/economy is NOT prohibitively expensive.

And I wouldnít trust anything OPEC says.

I recall a few years ago, they were talking about doing what was necessary to keep the price of oil around $80. Did they and the Saudis deliver on that? Pfft...

I donít think the Saudis or OPEC have any idea of what theyíre doing anymore.

But as long as there is war in the Middle East and as long as the Saudis are afraid of ISIS, oil prices will be depressed just like it was during the Iran-Iraq war of the 1980s.

By flooding the market with oil, the Saudis are waging an economic war on ISIS and anyone else who is a threat to their power. And staying in power is the only thing the Saudis care more about than money.

All the talk about the Saudis flooding the market to ďgain market shareĒ or to ďbankrupt US shale oil producersĒ are just minor sideshows compared to what they care about the most.

So after my long rambling, I say Yes, I think itís very likely stocks will bounce back. I think a company like FCA just might bounce back when it becomes obvious that we are NOT gonna see hugely higher oil prices by the end of the year and the Saudis/OPEC are once again, proven to be full of shit.

I do think this is the time to start slowly buying up energy-related stocks... but you have to be careful to buy one that doesnít go bankrupt.

Eventually oil prices will recover. But itís hard to say when. Itís better to be a little late than too early. But itís also important to realize that the Saudis can probably survive this low oil prices for at least another 4-5 years if they want.

In my own retirement portfolio, I have one fund that is energy/resource heavy and Iíve started putting 85% of my monthly contributions into that fund... partly to *gradually* rebalance my portfolio (it has taken a beating over the past year) and also to indirectly pick up energy/resource stocks cheap.